Local Governments are Gambling with your Taxpayer Dollars

Have you ever heard of a Pension Obligation Bond (POB)?

No? – Typically, POBs are a last-resort option for state and local governments. Ringing a bell? – Maybe because POBs were one of the factors that drove the City of San Bernardino into bankruptcy back in 2012.

What is a POB? They are taxable bonds issued by local government to alleviate the unfunded portion of pension debt. Essentially, they are substituting one debt for another. The proceeds from these bonds are paid directly to the pension funds that are serving the issuer’s employees. Meaning you, the taxpayer, will never see a dime. But you, the taxpayer, assume all the risk!

How does a POB affect me? As a county resident, prepare to be paying for the foreseeable future. POBs are generally designed to extend the principal payments and repayments over a longer period.

The California Debt and Investment Advisory Commission have referred to POBs as a double-edged sword. The Government Finance Officers Association issued an advisory stating “state and local governments should not issue POBs.” So why are County Supervisors using them? Poor budgeting, rising pensions, poor decision-making, and greediness has left them no choice!

Who are POBs for? Primarily local governments looking for a faster and riskier way to pay off debts. CalPERS (California Public Employees Retirement System) is an example. CalPERS funds government employee’s retirements for the City of San Bernardino, Fontana, Adelanto, Grand Terrace, Twentynine Palms, Upland, and the San Bernardino County Housing and Transportation Authorities, to name a few.

In June of 2020, CalPERS made the announcement that they will be betting 20% of their $400 billion-dollar on new assets, hoping to receive a return of 7% for the next 10 years. Keep in mind, 7% for the next 10 years is an ambitious goal.

Below is a list of pensions in your area that will be gambled with.

- San Bernardino Valley Water Conservation District

- San Bernardino Valley Municipal Water District

- San Bernardino County Transportation Authority

- San Bernardino County Housing Authority

- San Bernardino City Unified School District

- Rancho Cucamonga Fire Protection District

- Lake Arrowhead Community Services District

- Hesperia Unified School District

- Hesperia Fire Protection District

- Fontana Unified School District

- Crestline Lake Arrowhead Water Agency

- Crestline Village Water District

- City of Victorville

- City of Upland

- City of Twentynine Palms

- City of Rialto

- City of Redlands

- City of Rancho Cucamonga

- City of Needles

- City of Loma Linda

- City of Grand Terrace

- Big Bear City Community Services District

- Big Bear Municipal Water District

- Barstow Cemetery District

- Apple Valley Fire Protection District

- Town of Apple Valley

- Town of Yucca Valley

- Twentynine Palms Water District

In 2020 and 2019, CalPERS reported returns of an average of 5.7%, and saw its assets decrease by $70 billion in early 2020. In August of 2020, the Chief Investment Officer of CalPERS, the person who set that ambitious goal for the next 10 years, abruptly resigned; leaving America’s largest pool of money in question.

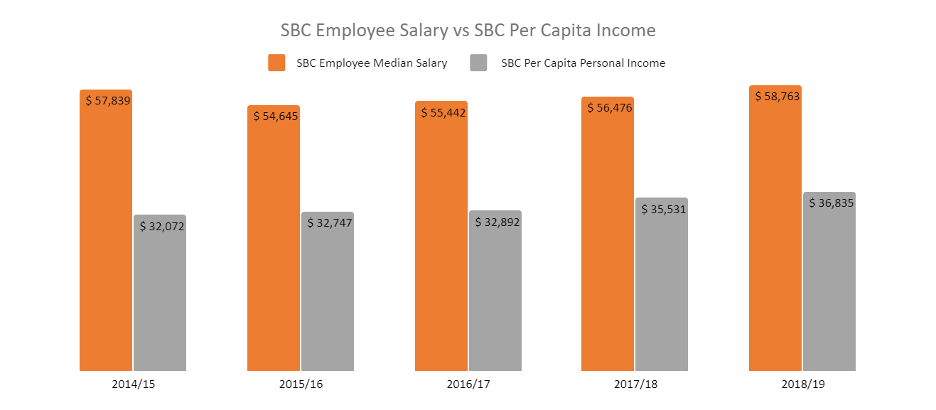

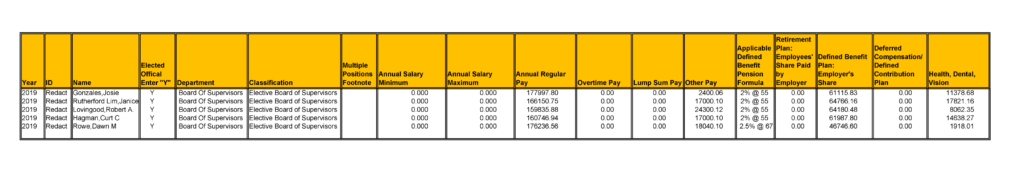

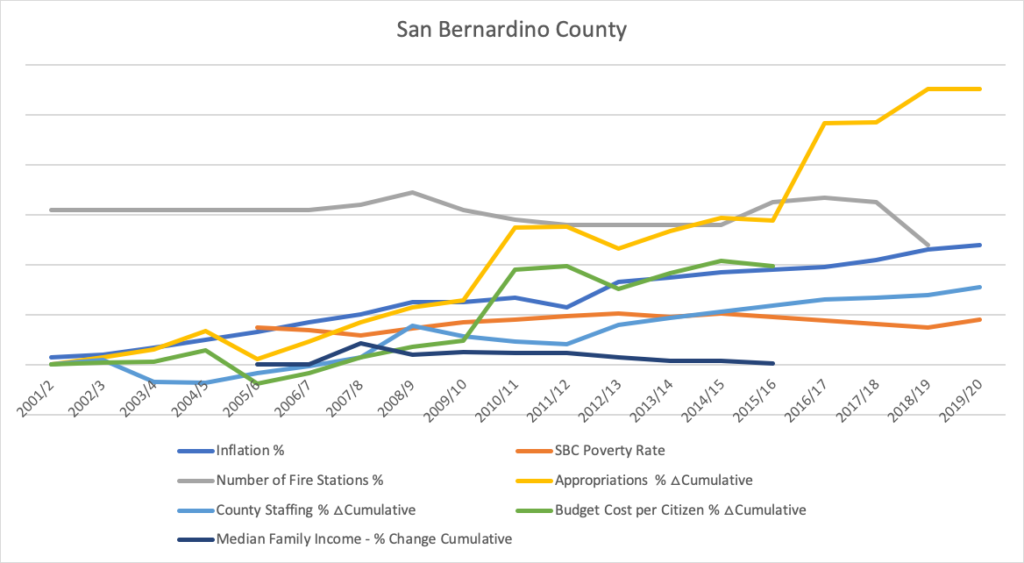

Why are they being issued? Public pension funds that are continually paying out exorbitant amounts of money to retired government workers, are deeply in debt. In 2018, the market pension debt for San Bernardino County was $11 .8 billion making the pension debt of every household in San Bernardino County $80,643 There are several reasons why pension liabilities continue to rise…

- Investment returns have been extremely volatile

- Government revenues are down

- Change in demographics such as longer retirements

Why are POBs so risky? They have a much higher risk of default because they offer a much higher rate of return. Local governments are essentially betting the bonds will provide a higher return that what is owed. That is a big gamble with your money; it will only continue to cost you. If the POB does not earn the high return the government is hoping for, the debt increases. Not only does the government now have a much higher credit and interest rate risk, but the gamble they are making is debt that you, the taxpayer, are obligated to pay.

While current San Bernardino County Supervisors try to look good by offering a solution of Pension Obligation Bonds, they are simply putting a burden on future generations. Deferring POB payments only increases the overall costs to the government. Jean-Pierre Aubry, the Director of State and Local Research at the Center for Retirement Research at Boston College, expressed a commonly held concern held by academia and industry. “Setting up bond payments…for the first five years as interest only —they are just kicking the can down the road, rather than amortizing the cost in the pension fund…” The debt incurred also represents assets unavailable for other purposes. It could be used for other purposes such as infrastructure, education, and bringing more jobs to the county.

What happens if the gamble does not work? Here are some examples from other counties / cities around our nation:

Stockton, California

In 2007, Stockton, California sold Pension Obligation Bonds worth roughly $125 million to pay off pension liabilities. For it to succeed, CalPERS needed to average a minimum return of 5.81% per year. Starting in 2008, CalPERS lost 25%, leaving the city to file for bankruptcy in 2012 to restructure not only their CalPERS debt, but their new debt caused by the unsuccessful POB gamble.

Detroit, Michigan

In 2005, Detroit, Michigan sold Pension Obligation Bonds worth roughly $1.4 billion to pay off pension liabilities. Suddenly, the pension deficit appeared to be solved without additional furloughs and lay-offs. However, in 2013, the city was obligated to pay their bondholders with cash they did not have, leaving the city to file for bankruptcy shortly after.

San Bernardino, California

In 2012, while bankruptcy allowed San Bernardino City to restructure their debts, the annual operating deficit still exists. Part of the reason, an ever-increasing CalPERS pension debt fueled by lower-than-expected returns. To alleviate their debt, the City of San Bernardino ceded control of their fire department to the county in 2016. As part of this deal, the county imposed an additional property tax on parcel owners within San Bernardino City – without their consent!

San Bernardino City’s pension debt is now San Bernardino County’s pension debt. Shifting the fire services to the county allowed the firefighters to be put on the county’s pension fund. Firefighters pensions were protected at the cost of increased taxes that were not approved by the citizens responsible to pay them.

We want to help San Bernardino County and see real change.

It starts with reducing compensation and term limits for our County Supervisors, and denying the supervisors a charter designed for the supervisors, not for the taxpayer! Vote Yes on Measure K. Vote No on Measure J.